ARE YOU OF LEGAL VAPE AGE?

Please confirm that you are of legal age to purchase vaping products to access our site.

Please confirm that you are of legal age to purchase vaping products to access our site.

Some items are no longer available. Your cart has been updated.

This discount code cannot be used in conjunction with other promotional or discounted offer.

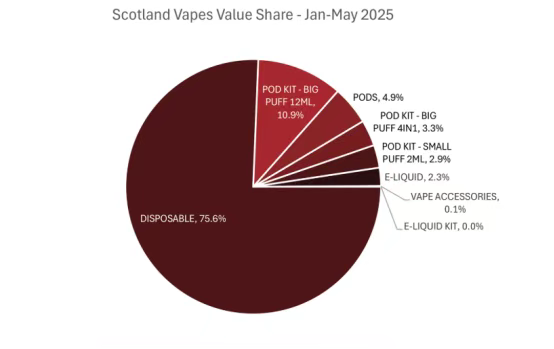

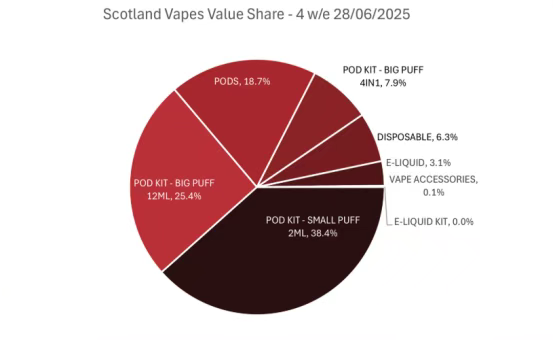

From June 1, 2025, the legal sale of disposable vapes in Scotland came to an end. The ban caused an immediate and steep drop in sales for the category — but it also sparked a surge of new device formats, setting the tone for the next phase of the UK vape market.

Drawing on the latest VAPEPIE data, we can clearly see how consumer preferences, brand rankings, and device categories are evolving, and where innovation is headed next.

Even with the ban, Scotland’s vape consumers haven’t shifted away from their love of fruit-and-ice combinations. The top-performing flavours in the post-ban period show strong continuity — with a growing appeal for mixed and seasonal blends that keep customers coming back.

Trend Insight: Fruit flavours vape continue to dominate, while limited-edition and hybrid blends are becoming a key strategy for driving repeat purchases.

Brand Sales Rankings: New Players Rise, Established Names Under Pressure

In the four weeks to June 28, 2025, Scotland’s Top 10 brands accounted for 93% of total market sales. The data shows a reshuffling of the leaderboard — with some newcomers experiencing explosive growth while established giants saw double-digit declines.

Before the ban:

After the ban:

This shift highlights how quickly consumers are moving toward refillable and multi-use systems when disposables are no longer an option.

Short-Term Winners

Mid-Term Innovation Drivers

Long-Term Opportunities

Scotland’s ban confirms one critical truth: regulation changes consumer habits far slower than new product innovation can.

The end of disposable vape sales in Scotland is not the final chapter — it’s the starting line for the next generation of UK vape devices. Brands that innovate fast, deliver familiar yet improved experiences, and invest in sustainable, connected designs will lead the industry’s next growth cycle.

Comment